Vietnam: Input costs and hog price developments in Q1 2024

The average first-quarter live pig price is up nearly 10% from the past 3 years.

Price developments of input materials in the first quarter of 2024

The price of 6-9 kg piglets ranged from 1.3-1.5 million VND/head (pigs raised by farmers) and 1.4-1.7 million VND/head (company pigs) in March. This price increased by 50 - 100 thousand VND/head compared to last month and increased by 200 - 500 thousand VND/head compared to the same period last year.

The price of compound feed for finishing pigs was 12,382 VND/kg (down about 0.1% compared to February 2024).

Prices of some main animal feed ingredients increased insignificantly as of March 2024:

| Raw material/feed | Mar 2023 | Feb 2024 | Mar 2024 |

|---|---|---|---|

| Corn | 8.500 | 6.956 | 6.866 |

| Soybean meal | 14.400 | 14.068 | 14.158 |

| Extracted rice bran | 5.780 | 5.915 | 5.945 |

| DDGS | 9.660 | 8.207 | 8.259 |

| Finisher compound feed | 12.340 | 12.395 | 12.382 |

Price of live-weight pigs

From the beginning of 2024 until now, the price of live pigs has increased by about 10,000 VND/kg and continued to increase slightly in the last days of March and is at 58-62,000 VND/kg depending on the province.

Vietnam's live pig price at the end of March and early April 2024 is about 10,000 VND/kg higher than China's.

Comparing the average price of live pigs in the first quarter of the past 3 years shows that the average price in the first quarter of 2024 is nearly 5,000 VND/kg higher (up 9.7%) compared to the same period in 2023.

With the production cost Currently appearing to range from 45 - 50,000 VND/kg, the current product selling price in the first quarter of 2024 will make pig farmers profitable.

http://cucchannuoi.gov.vn/trang-chu

Corn and soybean projections for the 2023/2024 season USDA – April 2024

World corn projections were lowered by 2.4 million tons compared to the March report. Soybean production, trade, and ending stock projections were cut slightly.

These are the highlights from the latest grain and oilseed estimates reports released by the USDA on April 11.

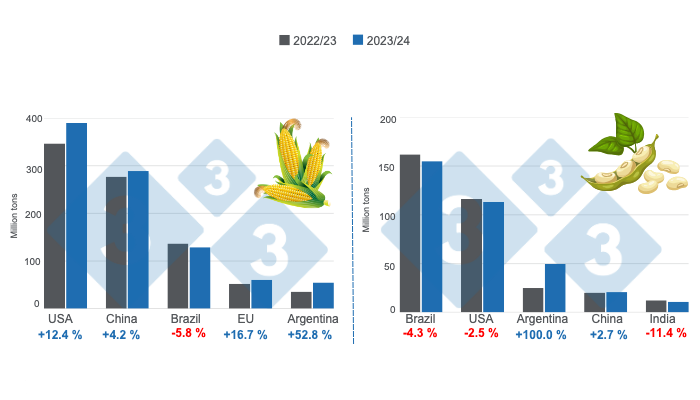

Graph 1. Crop projections for the main world corn and soybean producers - 2023/24 season versus 2022/23 season. Prepared by 333 Latin America with data from FAS - USDA.

Corn

- World corn production is expected to reach 1,227.9 million tons (Mt) in the 2023/24 season, representing an increase of 6.1% compared to 2022/23 (1,157.7 Mt).

- United States production is projected to be 389.7 Mt, increasing 12.4% compared to the previous season (346.7 Mt). China's harvest should increase by 4.2%, reaching 288.8 Mt. European Union production is expected to grow by 16.7% to reach 61 Mt, and Ukraine, with 29.5 Mt, would see an increase of 9.3%.

- Brazilian production is expected to reach 129 Mt, a decrease of 5.8% compared to the previous season, while Argentina's harvest is projected to reach 55 Mt, increasing 52.8% compared to last season's.

- World corn exports are forecast to increase by 11.3%, going from 180.2 Mt in the 2022/23 season to 200.6 Mt in this new season. The United States should be the largest exporter with 53.3 Mt, an increase of 26.4% compared to the previous season.

- The South American exportable supply is expected to increase significantly with Argentina's increasing 66.4% to 42.0 Mt in this new season. For Brazil, 52 Mt are estimated, a decrease of 4.2% compared to the previous season.

- China is expected to import 23 Mt of corn, an increase of 22.9% compared to the previous season (18.7 Mt), while the European Union is expected to import 21.0 Mt, 9.5% less than in the 2022/23 season (23.2 Mt).

- Final stocks are expected to increase 5.3% worldwide to reach 318.3 Mt. United States stocks would grow by 56%, while Brazil's would decrease by 45.9%.

Soybeans

- World soybean production for the 2023/24 season is anticipated to increase 4.9% compared to the previous season, going from 378.2 to 396.7 Mt.

- Estimates for South American harvests show a decrease of 4.3% for Brazil, which would reach 155 Mt, while an increase of 100.0% is projected for Argentina with 50.0 Mt.

- Paraguay is expected to increase its production by 4.5% compared to the 2022/23 season (10.1 Mt), to reach a harvest of 10.5 Mt.

- In this new report, the US crop is estimated at 113.3 Mt, a decrease of 2.5% compared to the 2022/23 season when it reached 116.2 Mt.

- Brazil should lead exports with 103.0 Mt, a 7.8% increase compared to the previous season (95.5 Mt). United States export volumes should reach 46.3 Mt, a decrease of 14.7% compared to the last harvest (54.2 Mt).

- Argentina is expected to export 4.6 Mt, which would mean an increase of 9.9% compared to the 2022/23 season (4.2 Mt).

- China is expected to import 105 Mt, 0.5% more than the previous season.

- Global soybean ending stocks are expected to increase by 12.7% to 114.2 Mt and would be supported by increases in stocks in Argentina, the United States, and China.

https://apps.fas.usda.gov/

The Netherlands: Voluntary cessation schemes for livestock farming extended with more funding

With this budget increase, the government assumes there are sufficient funds to honor all approved applications.

The budget for both the National Termination Scheme for Livestock Farming Locations (Lbv) and the Lbv-plus will increase by nearly € 1.45 billion. The voluntary termination scheme for the peak load approach, the Lbv-plus, will also be extended until December 20, 2024. The European Commission has approved proposals from the Netherlands to this end.

There is great interest in both the Lbv and the Lbv-plus, with over 1,300 applications. The government wants every entrepreneur who has taken the drastic decision to apply for a termination scheme (and meets the conditions) to be able to participate in the scheme. The government is therefore increasing the budget for the Lbv to € 1.102 billion, and a total of € 1.820 billion will be available for the Lbv-plus. With this budget increase, the government assumes there are sufficient funds to honor all approved applications.

The Lbv-plus scheme was originally open until April 5. As soon as the amended scheme comes into effect, the Lbv-plus will be open again retroactively and under the same conditions, until December 20, 2024. Applications submitted from April 6 are now being processed again by the RVO. The Lbv plus scheme is and remains a one-off.

https://www.rijksoverheid.nl/